Finding cheap insurance for auto can feel like navigating a maze. With so many options available , it’s easy to get overwhelmed. But don’t worry , securing affordable car insurance is achievable with the right approach. This thorough guide will walk you through the steps to find the optimal rates without compromising on coverage. We’ll explore everything from understanding your insurance needs to comparing quotes and taking benefit of discounts. Whether you’re a new driver or a seasoned pro , this article will offer you with the knowledge and tools you need to save money on your auto insurance. Let’s dive in and discover how to find cheap insurance for auto that fits your budget and offers the protection you need. And remember , it’s not just about the price; it’s about finding the right balance between cost and coverage. We’ll also touch on related topics like errors and omissions insurance , house insurance quotes , insurance quotes online , liability car insurance , and term life insurance quotes to give you a holistic view of your insurance needs.

Understanding Your Insurance Needs Before diving into the world of cheap insurance for auto , it’s crucial to understand your specific needs. What kind of coverage do you require? Are you looking for basic liability coverage, or do you need thorough protection that includes collision and thorough coverage? Consider your driving habits, the age and value of your vehicle, and your financial situation. This will help you determine the appropriate level of coverage and avoid overpaying for unnecessary attributes. For example, if you have an older car with low industry value, you might consider dropping collision and thorough coverage to save money. However , if you have a newer car or live in an area with a high risk of theft or vandalism, these coverages might be worth the investment. Don’t forget to explore options like errors and omissions insurance if you need professional liability coverage.

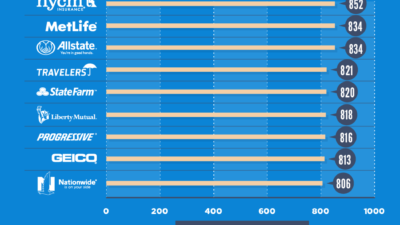

Comparing Insurance Quotes Online One of the most effective ways to find cheap insurance for auto is to compare insurance quotes online from multiple offerrs. Numerous websites and tools allow you to enter your information once and receive quotes from several varied companies. This saves you time and effort compared to contacting each insurer individually. When comparing quotes , be sure to look at the details of each policy, including the coverage limits, deductibles, and any exclusions. Don’t just focus on the price; make sure the policy offers adequate protection for your needs. Also , check the insurer’s financial strength and customer service ratings to ensure they are reliable and responsive in case of a claim. Many websites also offer house insurance quotes and term life insurance quotes , allowing you to compare rates for multiple types of insurance in one place.

Exploring Discounts and Savings Opportunities Insurance companies offer a variety of discounts that can help you lower your auto insurance premiums. Be sure to ask about all available discounts when requesting a quote. Common discounts include: Safe driver discount: If you have a clean driving record with no accidents or tickets, you may be eligible for a significant discount. Good student discount: Students with good grades can often qualify for a discount. Multi-policy discount: Bundling your auto insurance with other policies, such as house insurance or term life insurance , can outcome in substantial savings. Vehicle safety attributes discount: Cars equipped with safety attributes like anti-lock brakes, airbags, and anti-theft devices may qualify for a discount. Low mileage discount: If you drive fewer miles than average, you may be eligible for a discount. Membership discounts: Some insurers offer discounts to members of certain organizations or associations. By taking benefit of these discounts , you can significantly reduce the cost of your auto insurance.

Understanding varied Types of Auto Insurance Coverage Auto insurance policies typically include several varied types of coverage, each designed to protect you in varied situations. Understanding these coverages is essential for choosing the right policy and ensuring you have adequate protection. Liability coverage: This coverage protects you if you are at fault in an accident and cause injury or property damage to others. It pays for the other party’s medical expenses, car repairs, and other related costs. Collision coverage: This coverage pays for damage to your vehicle if you are involved in an accident, regardless of who is at fault. thorough coverage: This coverage protects your vehicle from damage caused by events other than collisions, such as theft, vandalism, fire, or natural disasters. Uninsured/underinsured motorist coverage: This coverage protects you if you are involved in an accident with a driver who has no insurance or insufficient insurance to cover your damages. Personal injury protection (PIP): This coverage pays for your medical expenses and lost wages if you are injured in an accident, regardless of who is at fault. When choosing your coverage limits , consider your assets and potential liabilities. Higher limits offer greater protection but also come with higher premiums. It’s also crucial to understand the difference between liability car insurance and other types of coverage.

Related Post : rowles real estate

Maintaining a Good Driving Record and Credit Score Your driving record and credit score can significantly impact your auto insurance rates. Insurers view drivers with clean driving records and good credit scores as less risky and are more likely to offer them lower premiums. To maintain a good driving record , avoid accidents and traffic violations. Even minor infractions can boost your insurance rates. To improve your credit score , pay your bills on time, keep your credit card balances low, and avoid opening too many new accounts at once. Regularly check your credit report for errors and dispute any inaccuracies. By maintaining a good driving record and credit score , you can demonstrate to insurers that you are a responsible driver and qualify for lower rates. Additionally , consider how errors and omissions insurance might affect your overall risk profile if you require it for professional reasons.

Finding cheap insurance for auto doesn’t have to be a daunting task. By understanding your needs, comparing quotes, and exploring available discounts, you can secure the coverage you need at a price that fits your budget. Remember to consider all facets of your insurance needs, including errors and omissions insurance, house insurance quotes, liability car insurance, and term life insurance quotes, to ensure thorough protection. With a little study and effort, you can drive with confidence knowing you’re adequately insured.