The world of cryptocurrency exchanges can be overwhelming. With so many platforms vying for your attention , it’s hard to know where to start. One of the first querys that often comes to mind is : “What exchange has the most cryptocurrencies ?” While the number of listed cryptocurrencies is certainly a factor to consider , it’s not the only one. In this thorough guide , we’ll delve into the intricacies of cryptocurrency exchanges , exploring the factors that make them tick and helping you select the platform that optimal suits your needs. We’ll also touch on related topics like cryptocurrency wallets , diversification , and risk management to equip you with the knowledge you need to navigate the crypto landscape with confidence.

What Exchange Has the Most Cryptocurrencies ? A Deep Dive

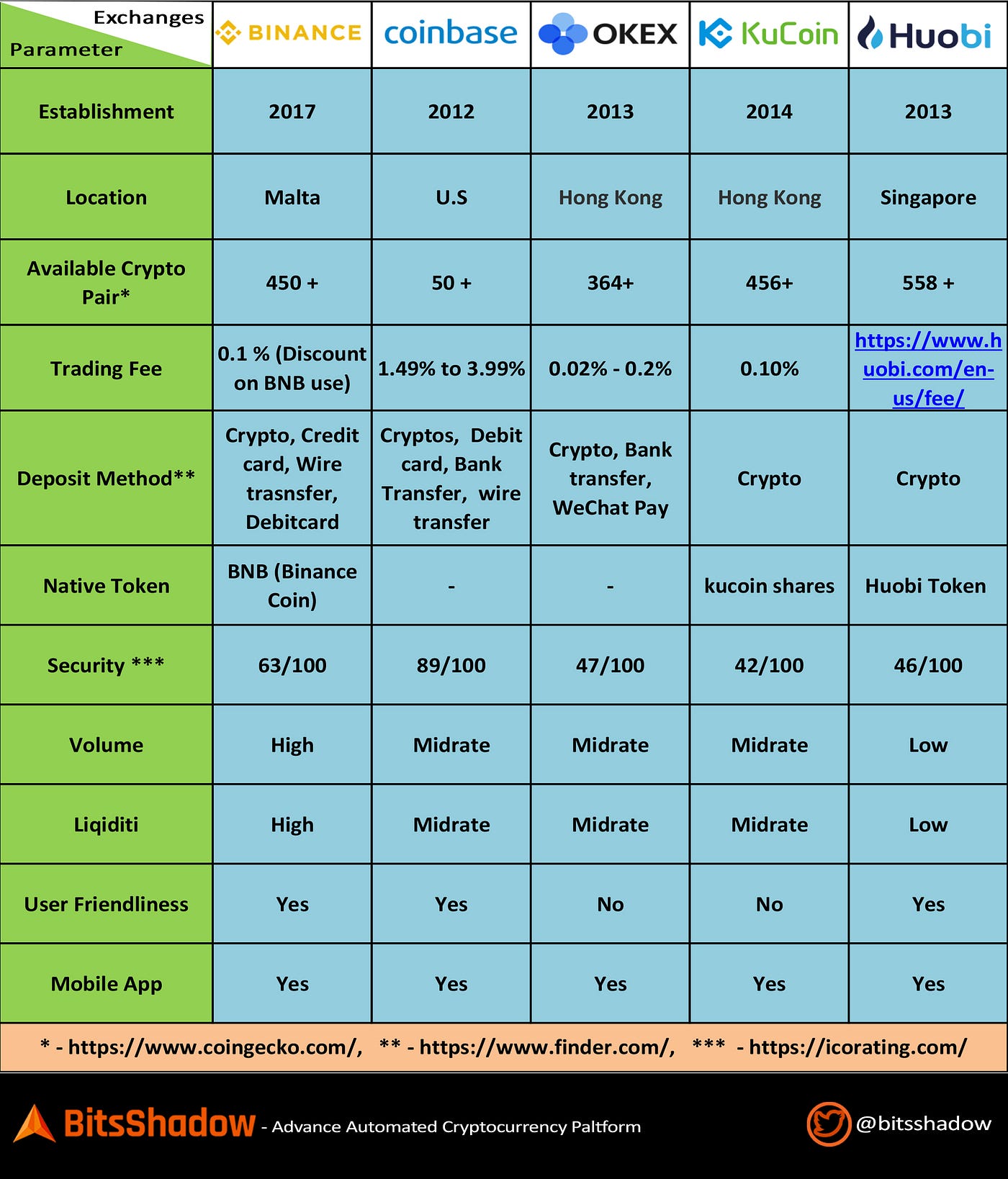

In the ever-expanding universe of digital assets , one query frequently pops up : “What exchange has the most cryptocurrencies ?” The answer , while seemingly straightforward , requires a nuanced understanding of the crypto industry. Several exchanges boast impressive lists of supported cryptocurrencies , each with its own strengths and weaknesses. Binance , KuCoin , and Gate.io are often cited as frontrunners in this category , offering hundreds , even thousands , of varied coins and tokens. However , quantity isn’t everything. It’s essential to consider factors like liquidity , security , regulatory compliance , and user experience before making a decision. A vast selection of obscure altcoins might seem appealing , but if those assets lack sufficient trading volume or are prone to scams , they could pose significant risks. Therefore , a balanced approach is key : look for an exchange that offers a diverse scope of reputable cryptocurrencies alongside emerging projects with promising potential.

Beyond Quantity : Evaluating Exchange Quality

While the sheer number of cryptocurrencies listed on an exchange is a significant factor , it’s equally crucial to assess the quality of those assets and the overall platform. Liquidity , for instance , plays a crucial function in ensuring smooth trading and minimizing price slippage. An exchange with high liquidity allows you to buy and sell cryptocurrencies quickly and efficiently , without significantly impacting the industry price. Security is another paramount concern. Look for exchanges that employ robust security measures , such as two-factor authentication , cold storage of funds , and regular security audits , to protect your assets from hackers and unauthorized access. Regulatory compliance is also essential , particularly in an evolving regulatory landscape. Exchanges that adhere to strict regulatory standards are more likely to be trustworthy and reliable in the long run. Finally , consider the user experience. A user-friendly interface , intuitive trading tools , and responsive customer support can make a world of difference , especially for beginners. What ‘s the optimal app to use for cryptocurrency ? Well , it depends on your individual needs and preferences , but a well-designed and easy-to-navigate platform is always a plus.

Related Post : do you buy cryptocurrency

Coinbase and Fidelity : A Closer Look at Popular Platforms

Coinbase and Fidelity are two of the most well-known and reputable platforms in the cryptocurrency space , but they cater to varied audiences and offer varying levels of cryptocurrency support. What cryptocurrency can you buy on Coinbase ? Coinbase offers a curated selection of popular cryptocurrencies , including Bitcoin , Ethereum , Litecoin , and a growing number of altcoins. It’s known for its user-friendly interface , robust security measures , and compliance with US regulations. Coinbase is a great option for beginners who are just starting to explore the world of cryptocurrency. What cryptocurrency does Fidelity support ? Fidelity , on the other hand , has taken a more cautious approach to cryptocurrency , initially focusing on providing custody services for institutional investors. However , it has recently expanded its offerings to include cryptocurrency trading for retail customers. Fidelity’s cryptocurrency selection is currently more limited than Coinbase’s , but it’s expected to grow over time. Fidelity is a good option for investors who already have existing accounts with the company and prefer to keep all of their assets in one place.

Choosing the Right Cryptocurrency Wallet

In addition to selecting the right exchange , it’s also crucial to select a secure and reliable cryptocurrency wallet to store your digital assets. What cryptocurrency wallet to use ? There are several types of wallets available , each with its own benefits and disbenefits. Hardware wallets , such as Ledger and Trezor , are considered the most secure option , as they store your private keys offline , away from the reach of hackers. Software wallets , such as Exodus and Electrum , are more convenient to use , but they are also more vulnerable to security threats. Online wallets , also known as web wallets , are the easiest to access , but they are also the least secure. When choosing a cryptocurrency wallet , consider factors like security , convenience , supported cryptocurrencies , and user interface. It’s also a good idea to enable two-factor authentication and regularly back up your wallet to protect your funds in case of loss or theft.

Diversification and Risk Management

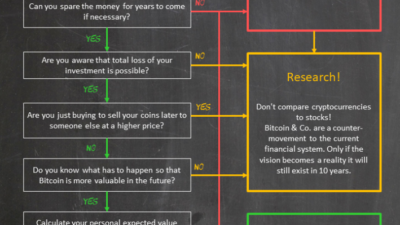

Regardless of which exchange or wallet you select , it’s essential to practice diversification and risk management when investing in cryptocurrency. Cryptocurrency is a highly volatile asset class , and prices can fluctuate dramatically in short periods of time. Don’t put all of your eggs in one basket. Diversify your holdings across multiple cryptocurrencies to reduce your overall risk. Only invest what you can afford to lose , and never borrow money to invest in cryptocurrency. Do your own study before investing in any cryptocurrency , and be wary of scams and Ponzi schemes. Remember that past performance is not indicative of future outcomes , and there are no guarantees of profit in the cryptocurrency industry. By following these instructions , you can minimize your risk and boost your chances of achievement in the long run.

Navigating the cryptocurrency exchange landscape can feel like traversing a digital jungle. With so many options vying for your attention , it’s crucial to do your homework. Consider your individual needs , risk tolerance , and investment objectives before settling on an exchange. Whether you prioritize sheer volume of cryptocurrencies , user-friendliness , robust security , or low fees , the perfect platform is out there waiting to be discovered. Remember to stay informed , diversify your holdings , and always invest responsibly. Happy trading !