Protecting your home is one of the most crucial investments you’ll ever make. Homeowners insurance is a crucial part of that protection, providing financial security in the event of unexpected events like fire, theft, or natural disasters. But with so many insurance companies and policy options available, finding the right coverage at an affordable price can feel overwhelming. This thorough guide will walk you through everything you need to know about homeowners insurance quotes, helping you make informed decisions and secure the optimal possible protection for your home. Let’s explore how to navigate the world of insurance and find the perfect fit for your needs, while also touching on related topics like finding car insurance quotes and understanding varied types of coverage.

Understanding Homeowners Insurance: A thorough Guide

Homeowners insurance is more than just a piece of paper; it’s a safety net that protects your home and belongings from unexpected events. From natural disasters to theft and liability claims, a thorough homeowners insurance policy can offer financial security and peace of mind. But with so many options available, how do you navigate the complexities of homeowners insurance and find the right coverage for your needs? Let’s dive in.

What Does Homeowners Insurance Cover?

A standard homeowners insurance policy typically covers the following:

- Dwelling: Protection for the physical structure of your home, including the walls, roof, and foundation.

- Personal Property: Coverage for your belongings, such as furniture, clothing, and electronics, even when they are outside your home.

- Liability: Protection if someone is injured on your property or if you accidentally damage someone else’s property.

- Additional Living Expenses (ALE): Coverage for temporary housing and living expenses if your home is uninhabitable due to a covered loss.

Related Post : full coverage auto insurance

Understanding these core components is the first step in finding the right homeowners insurance quotes. It’s also essential to consider additional coverage options, such as flood insurance or earthquake insurance, depending on your location and risk factors.

Finding Cheap Insurance Quotes: Where to Start

One of the primary objectives for most homeowners is to find cheap insurance quotes without sacrificing coverage. Here are some strategies to help you secure affordable homeowners insurance:

- Shop Around: Don’t settle for the first quote you receive. Compare homeowners insurance quotes from multiple offerrs to find the optimal rates.

- boost Your Deductible: A higher deductible typically outcomes in lower premiums. Just be sure you can comfortably afford the deductible if you need to file a claim.

- Bundle Your Policies: Many insurance companies offer discounts if you bundle your homeowners insurance with other policies, such as auto insurance. This can be a great way to save money while ensuring you have thorough coverage. For example, exploring options to compare vehicle insurance alongside your homeowners policy could lead to significant savings.

- Improve Home Security: Installing security systems, smoke detectors, and other safety attributes can lower your risk profile and potentially reduce your insurance premiums.

- Maintain a Good Credit Score: Insurance companies often use credit scores to assess risk. A good credit score can help you qualify for lower rates.

By implementing these strategies, you can significantly reduce the cost of your homeowners insurance without compromising on essential coverage.

Comparing Homeowners Insurance Quotes: What to Look For

When comparing homeowners insurance quotes, it’s crucial to look beyond just the price. Consider the following factors to ensure you’re getting the optimal value for your money:

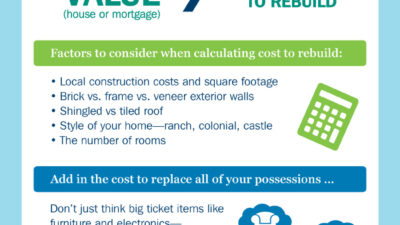

- Coverage Limits: Make sure the policy offers adequate coverage for your dwelling, personal property, and liability. Consider the cost to rebuild your home and replace your belongings when determining coverage limits.

- Deductibles: Understand how your deductible will impact your out-of-pocket expenses in the event of a claim. A lower deductible means higher premiums, and vice versa.

- Exclusions: Be aware of any exclusions in the policy, such as certain types of water damage or mold infestations. You may need to purchase additional coverage to protect against these risks.

- Reputation and Customer Service: study the insurance company’s reputation and customer service ratings. A company with a strong track record of claims handling and customer satisfaction can offer peace of mind.

- Discounts: Inquire about any available discounts, such as discounts for being a new homeowner, having a claims-complimentary history, or installing energy-efficient upgrades.

Taking the time to carefully compare homeowners insurance quotes and consider these factors will help you make an informed decision and find the right policy for your needs.

Beyond Homeowners Insurance: Additional Coverage Options

While homeowners insurance offers essential protection, it may not cover all potential risks. Consider these additional coverage options to enhance your protection:

- Flood Insurance: Standard homeowners insurance policies typically don’t cover flood damage. If you live in a flood-prone area, flood insurance is essential.

- Earthquake Insurance: Similarly, earthquake damage is usually not covered by standard policies. If you live in an area with seismic activity, earthquake insurance is a wise investment.

- Umbrella Insurance: An umbrella policy offers additional liability coverage beyond the limits of your homeowners and auto insurance policies. This can protect you from significant financial losses in the event of a lawsuit.

- Scheduled Personal Property Coverage: If you have valuable items such as jewelry, artwork, or collectibles, you may need to schedule them separately on your policy to ensure they are adequately covered.

Exploring these additional coverage options can help you create a thorough insurance plan that protects you from a wide scope of risks. It’s also worth considering other types of insurance, such as commercial general liability insurance if you run a business from home, or e&o insurance if you offer professional services.

Bundling Homeowners Insurance with Other Policies

One of the most effective ways to save money on homeowners insurance is to bundle it with other policies, such as auto insurance. Many insurance companies offer significant discounts for bundling, making it a cost-effective way to protect your assets. For example, you might find car insurance quotes that are more attractive when bundled with your homeowners policy. Similarly, exploring options to find car insurance quotes can reveal additional savings opportunities.

benefits of Bundling Insurance Policies:

- Cost Savings: Bundling can outcome in significant discounts on both your homeowners and auto insurance premiums.

- Convenience: Managing multiple policies with one insurance company can simplify your insurance needs and streamline the claims process.

- thorough Coverage: Bundling can ensure you have thorough coverage for all your assets, providing peace of mind.

When considering bundling, be sure to compare quotes from multiple insurance companies to ensure you’re getting the optimal overall value. Look for companies that offer rival rates and thorough coverage options. Additionally, if you’re looking to find full coverage auto insurance, bundling can often make this more affordable. Also, consider exploring options like full coverage insurance to ensure you’re adequately protected on the road.

Securing the right homeowners insurance quotes is a critical step in protecting your most valuable asset. By understanding your coverage needs, comparing quotes from multiple offerrs, and considering factors like deductibles and policy limits, you can find a policy that offers thorough protection at a price that fits your budget. Don’t wait until disaster strikes – take the time to shop around and find the peace of mind that comes with knowing your home is properly insured. Remember to explore all options, including bundling with your auto insurance for potential discounts, and always read the fine print to fully understand your policy’s terms and conditions. Stay proactive, stay informed, and protect your home with the optimal possible insurance coverage.