Finding the right insurance car coverage can feel like navigating a maze. With so many options available, from basic liability to full coverage auto insurance, it’s essential to understand the varied types of policies and how they can protect you. Whether you’re searching for cheap insurance quotes, comparing vehicle insurance options, or exploring specialized coverage like commercial general liability insurance or e&o insurance, this guide will offer you with the information you need to make informed decisions. Let’s dive in and explore the world of car insurance to help you find the optimal fit for your needs and budget. And don’t forget to consider other insurance needs, such as homeowners insurance quotes or health coverage from companies like Humana Insurance Company, to ensure you’re fully protected.

Understanding the Basics of Car Insurance.

Car insurance is a contract between you and an insurance company that protects you against financial loss in the event of an accident or theft. In exchange for your paying a premium, the insurance company agrees to pay your losses as outlined in your policy. Car insurance offers coverage for:

- Property damage: Covers damage to your vehicle or another person’s vehicle or property.

- Bodily injury: Covers medical expenses, lost wages, and pain and suffering outcomeing from an accident.

- Liability: Covers your legal responsibility if you are at fault in an accident.

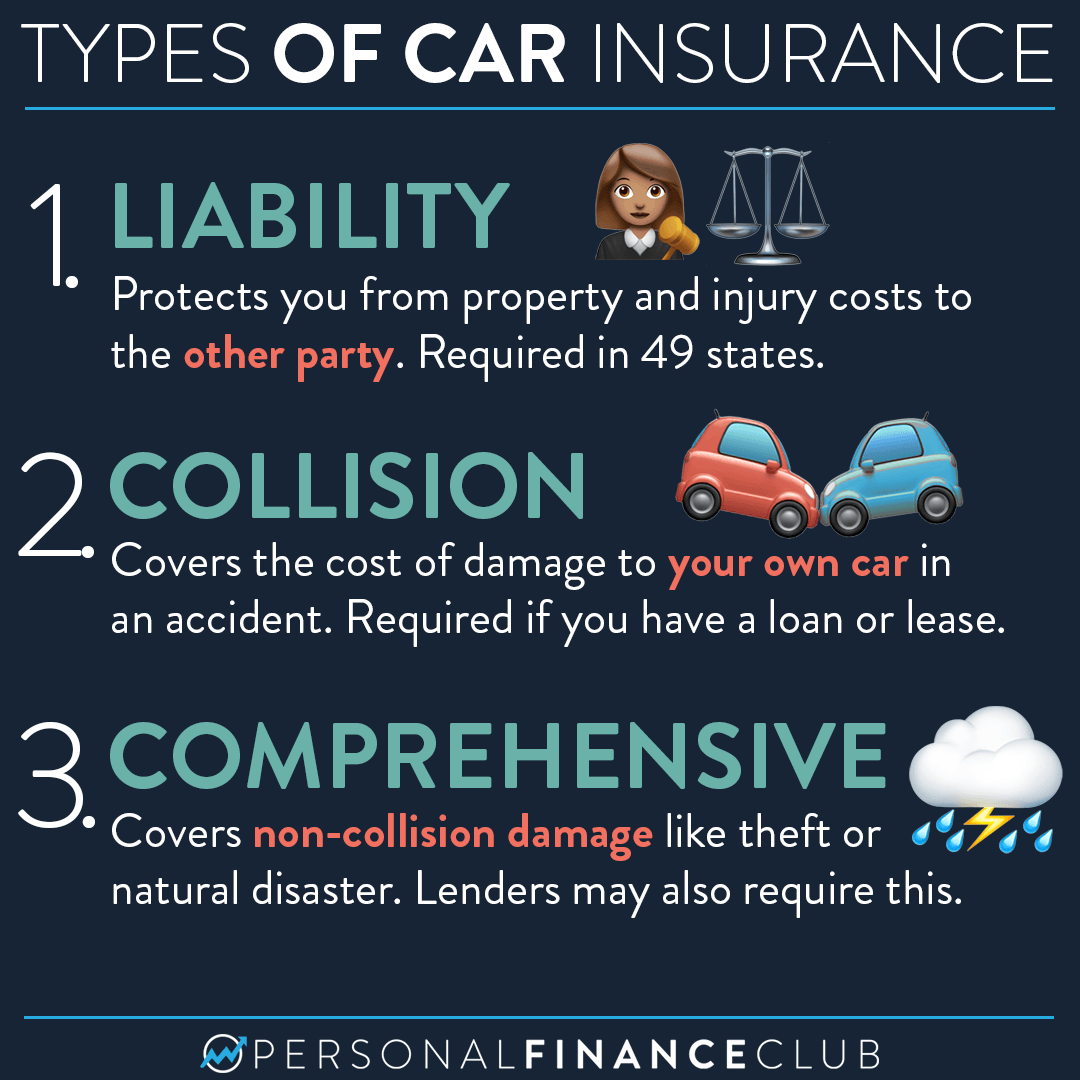

There are several types of car insurance coverage, including:

- Liability coverage: Pays for the other driver’s expenses if you are at fault in an accident.

- Collision coverage: Pays for damage to your car if you collide with another vehicle or object.

- thorough coverage: Pays for damage to your car from events other than collisions, such as theft, vandalism, or natural disasters.

- Uninsured/underinsured motorist coverage: Pays for your expenses if you are hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your losses.

Finding Cheap Insurance Quotes.

Related Post : full coverage auto insurance

One of the primary concerns for many drivers is finding cheap insurance quotes. The cost of car insurance can vary significantly depending on several factors, including:

- Your age and driving experience.

- Your driving record.

- The type of car you drive.

- Your location.

- The coverage limits you select.

To find the optimal rates, it’s essential to shop around and compare quotes from multiple insurance companies. Here are some tips for finding cheap insurance quotes:

- Get quotes from multiple insurers: Don’t settle for the first quote you receive. Compare rates from at least three to five varied companies to see who offers the optimal deal.

- boost your deductible: A higher deductible means you’ll pay more out of pocket if you have an accident, but it can also lower your premium.

- Look for discounts: Many insurers offer discounts for things like being a safe driver, having multiple policies with the same company, or being a member of certain organizations.

- Consider application-based insurance: Some insurers offer programs that track your driving habits and reward safe drivers with lower rates.

The Importance of Full Coverage Auto Insurance.

While liability coverage is often the minimum required by law, full coverage auto insurance offers more thorough protection. Full coverage typically includes collision and thorough coverage, in addition to liability. Here’s why full coverage insurance is worth considering:

- Protection against a wide scope of risks: Full coverage protects you from damage caused by accidents, theft, vandalism, natural disasters, and more.

- Financial security: If your car is damaged or totaled, full coverage can help you replace it without incurring significant financial hardship.

- Peace of mind: Knowing you have thorough coverage can give you peace of mind while driving.

When deciding whether to get full coverage, consider the value of your car and your ability to pay for repairs or replacement out of pocket. If you have a newer or more valuable vehicle, full coverage is generally a good idea.

Exploring Commercial General Liability Insurance and E&O Insurance.

For business owners, commercial general liability insurance and e&o insurance are essential for protecting their companies from financial losses.

- Commercial General Liability Insurance: This type of insurance protects your business from financial losses if someone is injured on your property or if your business is responsible for property damage. It can cover medical expenses, legal fees, and damages awarded in a lawsuit.

- E&O Insurance (Errors and Omissions Insurance): Also known as professional liability insurance, e&o insurance protects your business from lawsuits alleging negligence, errors, or omissions in the professional services you offer. This is particularly crucial for businesses that offer advice or expertise to clients.

Both commercial general liability insurance and e&o insurance are crucial for protecting your business from potentially devastating financial losses. Make sure to assess your business’s risks and select the right coverage to meet your needs.

Comparing Vehicle Insurance Options and Finding the Right Fit.

Choosing the right car insurance can be a complex process, but it’s essential to take the time to compare vehicle insurance options and find the coverage that optimal meets your needs. Here are some factors to consider when comparing policies:

- Coverage limits: Make sure the policy offers adequate coverage for your needs. Consider how much liability coverage you need to protect yourself from lawsuits, and how much collision and thorough coverage you need to repair or replace your vehicle.

- Deductibles: select a deductible that you can afford to pay out of pocket if you have an accident. A higher deductible will lower your premium, but you’ll need to be prepared to pay more if you have a claim.

- Exclusions: Be aware of any exclusions in the policy that may limit coverage. For example, some policies may not cover certain types of damage or may exclude certain drivers.

- Reputation of the insurer: select an insurance company with a good reputation for customer service and claims handling. Check online reviews and ratings to see what other customers have to say.

By carefully comparing your options and considering your individual needs, you can find the right car insurance policy to protect yourself and your vehicle.

Navigating the world of car insurance can feel overwhelming, but with the right knowledge and resources, you can find the perfect coverage to protect yourself and your vehicle. Remember to compare vehicle insurance options, explore cheap insurance quotes, and consider full coverage auto insurance for thorough protection. Whether you’re looking for general car insurance or need specialized coverage like commercial general liability insurance or e&o insurance, taking the time to study and compare quotes will ensure you get the optimal value for your money. Don’t forget to explore other insurance needs, such as homeowners insurance quotes or health insurance options like Humana Insurance Company, to ensure you’re fully protected in all facets of your life. By being proactive and informed, you can drive with confidence knowing you have the right insurance car coverage in place.