In the realm of personal finance, few things are as crucial as securing adequate auto insurance. Whether you’re a seasoned driver or a new car owner, understanding the ins and outs of full coverage auto insurance is paramount. But what exactly does “full coverage” entail, and how can you find cheap insurance quotes without compromising on protection? This thorough guide will delve into the intricacies of full coverage auto insurance , exploring its key components, cost-saving strategies, and the importance of comparing vehicle insurance options. We’ll also touch upon other essential insurance needs, such as homeowners insurance quotes , commercial general liability insurance , and even health coverage options like those offered by humana insurance company . So, buckle up and get ready to navigate the world of auto insurance with confidence!

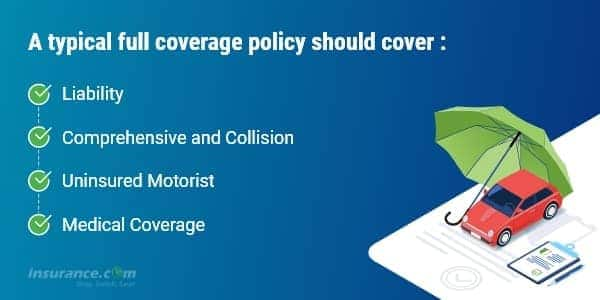

Understanding Full Coverage Auto Insurance : What Does It Really Mean? Full coverage auto insurance isn’t just a catchy phrase; it represents a thorough level of protection for your vehicle and yourself. Unlike liability-only insurance, which only covers damages you cause to others, full coverage encompasses a broader scope of incidents. This typically includes collision coverage, which pays for damages to your car outcomeing from an accident, regardless of fault. It also includes thorough coverage, protecting your vehicle from non-collision events like theft, vandalism, fire, or natural disasters. But what does this mean for you practically? Imagine you’re driving home one evening and a deer jumps out in front of your car. With full coverage, the repairs to your vehicle would be covered, minus your deductible. Or, consider if your car is stolen from your driveway. thorough coverage would help replace your vehicle, easing the financial burden of such a loss. While the exact details of full coverage can vary depending on your insurance offerr and policy, it generally offers a more robust safety net than basic liability coverage. This is especially crucial if you rely heavily on your vehicle or if you live in an area prone to accidents or natural disasters. Finding the right full coverage auto insurance involves understanding your individual needs and comparing varied policies to find the optimal fit. Don’t be afraid to ask querys and clarify any uncertainties before making a decision.

The Key Components of Full Coverage : Collision and thorough. Diving deeper into full coverage auto insurance , it’s crucial to understand the two main pillars: collision and thorough coverage. Collision coverage steps in when your vehicle is damaged in an accident, whether it’s with another car, a stationary object, or even a pothole. It doesn’t matter who is at fault; collision coverage will help pay for the repairs to your vehicle, up to the policy’s limit, minus your deductible. thorough coverage, on the other hand, protects your vehicle from a wider scope of incidents that aren’t related to collisions. This includes things like theft, vandalism, fire, hail, flood, and even damage from falling objects. For example, if a tree branch falls on your car during a storm, thorough coverage would help cover the cost of repairs. The deductible you select for both collision and thorough coverage will impact your premium. A higher deductible typically means a lower premium, but it also means you’ll pay more out-of-pocket in the event of a claim. Conversely, a lower deductible means a higher premium, but you’ll pay less out-of-pocket when you file a claim. When deciding on your deductible, consider your risk tolerance and financial situation. It’s also crucial to note that full coverage auto insurance typically includes uninsured/underinsured motorist coverage, which protects you if you’re hit by a driver who doesn’t have insurance or doesn’t have enough insurance to cover your damages. This can be a valuable addition to your policy, especially in areas with a high number of uninsured drivers.

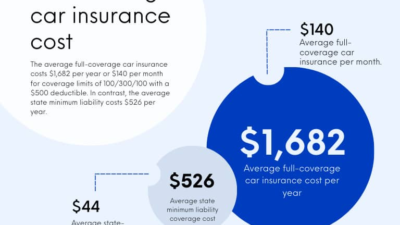

Finding Cheap Insurance Quotes for Full Coverage : Is It Possible? Securing full coverage auto insurance doesn’t have to break the bank. While it’s generally more expensive than liability-only coverage, there are several strategies you can use to find cheap insurance quotes and lower your premiums. One of the most effective ways to save money is to shop around and compare quotes from multiple insurance companies. Don’t settle for the first quote you receive; take the time to study varied offerrs and see what they offer. Online comparison tools can be helpful in this process, allowing you to quickly compare rates from multiple insurers. Another way to lower your premiums is to boost your deductible. As mentioned earlier, a higher deductible means a lower premium. However, be sure to select a deductible that you can comfortably afford to pay out-of-pocket in the event of a claim. You can also explore discounts offered by insurance companies. Many insurers offer discounts for things like being a safe driver, having multiple policies with the same company (e.g., bundling your auto and homeowners insurance quotes ), being a student, or having certain safety attributes in your vehicle. Maintaining a good credit score can also help you get lower insurance rates. Insurers often use credit scores as a factor in determining premiums, so improving your credit score can lead to significant savings. Finally, consider the type of vehicle you drive. Some vehicles are more expensive to insure than others, so choosing a car that is known for being safe and reliable can help lower your insurance costs. Remember, finding cheap insurance quotes requires effort and study, but it’s possible to get full coverage without overspending.

Beyond Auto : Exploring Other Insurance Needs. While full coverage auto insurance is essential for protecting your vehicle, it’s crucial to consider your other insurance needs as well. Homeowners insurance quotes , for example, are crucial for protecting your home and belongings from damage or loss. Just like with auto insurance, it’s crucial to shop around and compare quotes from multiple insurers to find the optimal coverage at the optimal price. If you’re a business owner, you may also need commercial general liability insurance to protect your business from lawsuits and other financial liabilities. This type of insurance can help cover the costs of legal defense, settlements, and judgments. E&O insurance , or errors and omissions insurance, is another crucial type of coverage for professionals who offer advice or services. This insurance protects you from claims of negligence or errors in your professional work. In addition to property and liability insurance, it’s also crucial to consider your health insurance needs. Companies like humana insurance company offer a variety of health insurance plans to help you cover the costs of medical care. Choosing the right health insurance plan can be complex, so it’s crucial to understand your options and select a plan that meets your individual needs. By considering all of your insurance needs, you can create a thorough safety net that protects you and your family from a wide scope of risks.

Related Post : compare vehicle insurance

Comparing Vehicle Insurance : Making the Right Choice. With so many varied insurance companies and policies available, comparing vehicle insurance can feel overwhelming. However, taking the time to compare your options is essential for finding the right coverage at the right price. Start by determining your coverage needs. What level of protection do you need? Do you want full coverage, or is liability-only coverage sufficient? Consider your risk tolerance and financial situation when making this decision. Once you know your coverage needs, you can start shopping around and comparing quotes from multiple insurers. Be sure to compare the same coverage levels and deductibles when comparing quotes to ensure you’re getting an accurate comparison. Pay attention to the details of each policy, including the coverage limits, deductibles, and exclusions. Make sure you understand what is and isn’t covered by the policy. Read reviews and ratings of varied insurance companies to get an idea of their customer service and claims handling. select an insurer with a good reputation for providing prompt and fair claims service. Don’t be afraid to ask querys and clarify any uncertainties before making a decision. A good insurance agent should be able to answer your querys and help you select the right policy for your needs. Finally, remember that the cheapest insurance policy isn’t always the optimal choice. Focus on finding a policy that offers adequate coverage at a reasonable price. Protecting yourself and your vehicle is an investment in your peace of mind.

Navigating the world of auto insurance can feel overwhelming, but understanding your options is the first step towards securing the right coverage. Whether you’re looking for cheap insurance quotes , exploring full coverage auto insurance , or comparing vehicle insurance , remember to prioritize your needs and budget. Don’t hesitate to shop around, compare quotes, and ask querys to ensure you’re making an informed decision. Protecting yourself and your vehicle is an investment in your peace of mind. And remember, exploring options beyond auto insurance, such as homeowners insurance quotes or even looking into health coverage with companies like humana insurance company , can offer a thorough safety net for you and your family.