In the realm of insurance, the term “full coverage” often surfaces as the gold standard for protection. But what does full coverage insurance truly entail, and why is it so highly recommended? This thorough guide will delve into the intricacies of full coverage auto insurance, exploring its components, benefits, and how to find the optimal policy for your needs. We’ll also touch on related insurance ideas, such as commercial general liability insurance , homeowners insurance , and even health coverage options like those offered by humana insurance company . Whether you’re looking to find car insurance quotes , compare vehicle insurance , or simply understand the landscape of insurance options, this article aims to offer clarity and actionable insights.

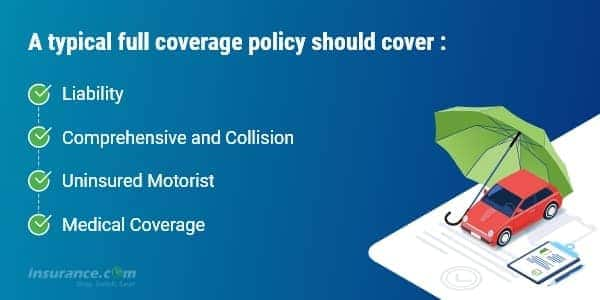

Understanding Full Coverage Insurance: What Does It Really Mean? Full coverage auto insurance isn’t a specific type of policy, but rather a combination of coverages designed to offer thorough protection. Typically, it includes liability coverage, collision coverage, and thorough coverage. Liability coverage protects you if you’re at fault in an accident, covering the other party’s injuries and property damage. Collision coverage pays for damage to your vehicle outcomeing from a collision with another vehicle or object, regardless of who is at fault. thorough coverage protects your vehicle from other types of damage, such as theft, vandalism, fire, or natural disasters. For businesses, understanding commercial general liability insurance is equally crucial. It protects against financial losses from bodily injury, property damage, and personal or advertising injury claims arising from your business operations.

The Key Components of Full Coverage: Liability, Collision, and thorough. Diving deeper into the components, liability coverage is often the cornerstone of any auto insurance policy. It’s essential to have adequate liability limits to protect your assets in case of a serious accident. Collision coverage is particularly valuable if you live in an area with heavy traffic or a high risk of accidents. It ensures that your vehicle can be repaired or replaced, regardless of fault. thorough coverage offers a broader safety net, protecting against unforeseen events that can cause significant damage. When you find car insurance quotes , make sure to carefully review the coverage details and limits to ensure they meet your needs. For professionals, e&o insurance (errors and omissions insurance) is a critical form of protection. It covers legal costs and damages if you’re sued for negligence or mistakes in your professional services.

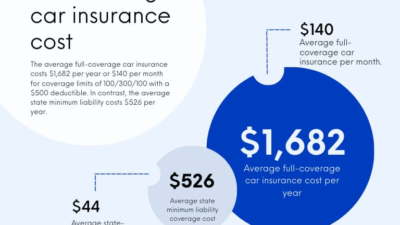

Why select Full Coverage? Weighing the benefits and Costs. Opting for full coverage insurance offers several benefits. It offers peace of mind knowing that you’re protected from a wide scope of potential losses. It can also save you significant money in the long run if you’re involved in a major accident or your vehicle is damaged by an unexpected event. However, full coverage typically comes with a higher premium compared to minimum coverage policies. It’s crucial to weigh the benefits against the costs and determine what level of coverage is right for you. Consider factors such as the value of your vehicle, your risk tolerance, and your financial situation. Exploring cheap insurance quotes can help you find affordable options without sacrificing essential coverage.

Finding the optimal Full Coverage Policy: Tips for Comparing Quotes. Shopping around and comparing quotes is crucial when looking for full coverage insurance. Start by gathering quotes from multiple insurance companies. Online tools can make this process easier, allowing you to compare vehicle insurance from varied offerrs side by side. Pay attention to the coverage details, limits, and deductibles. A lower premium may come with higher deductibles, which means you’ll have to pay more out of pocket if you file a claim. Also, consider the reputation and customer service of the insurance company. Reading reviews and checking ratings can offer valuable insights. Don’t forget to inquire about discounts. Many insurance companies offer discounts for safe drivers, students, military personnel, and bundling multiple policies. For homeowners, bundling your auto and homeowners insurance quotes can often outcome in significant savings.

Related Post : full coverage auto insurance

Beyond Auto: Extending Full Coverage Principles to Home and Health. The idea of full coverage extends beyond auto insurance. Homeowners insurance offers thorough protection for your home and belongings, covering damage from fire, theft, vandalism, and natural disasters. It also includes liability coverage to protect you if someone is injured on your property. When comparing homeowners insurance quotes , consider the replacement cost of your home and the value of your personal property. Health insurance is another essential form of full coverage. It protects you from the high costs of medical care, including doctor visits, hospital stays, and prescription drugs. Companies like humana insurance company offer a variety of health insurance plans to meet varied needs and budgets. Understanding the varied types of health insurance coverage and comparing plans is crucial to finding the right fit for you and your family.

Choosing the right full coverage insurance is a significant decision. By understanding what it entails, comparing quotes, and assessing your individual needs, you can secure a policy that offers peace of mind and financial protection. Don’t hesitate to explore options like cheap insurance quotes and compare vehicle insurance to find the optimal fit for your budget and lifestyle. Remember, investing in thorough coverage is an investment in your future security.