Ethereum trading profits: the holy grail of crypto investing, or a gambler’s fallacy? This isn’t your grandpa’s stock market; the volatility of Ethereum demands a nuanced approach. We’ll dive deep into strategies, risk management, and the crucial factors influencing your bottom line – from understanding market sentiment to mastering technical analysis. Get ready to navigate the wild world of Ethereum trading and potentially reap the rewards (while minimizing the risks, of course).

From day trading’s adrenaline rush to the patient strategy of long-term holding, we’ll break down various approaches, comparing their risk-reward profiles and helping you find the perfect fit for your investment style and risk tolerance. We’ll also unpack the importance of understanding economic indicators, technical analysis, and even the tax implications of your crypto gains. Think of this as your ultimate survival guide to conquering the Ethereum market.

Ethereum Trading Strategies for Profit

Navigating the volatile world of Ethereum trading requires a well-defined strategy. Success hinges not just on market timing, but also on understanding your risk tolerance and aligning your approach with your financial goals. Let’s delve into the different strategies employed by Ethereum traders, examining their strengths and weaknesses.

Ethereum Trading Strategies: A Comparative Overview

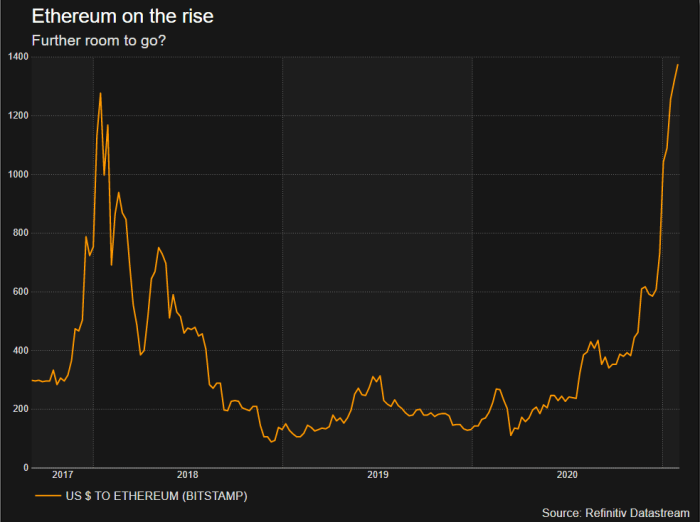

Ethereum, with its fluctuating price, presents diverse opportunities for profit. Three prominent strategies stand out: day trading, swing trading, and long-term holding. Each demands a different approach, time commitment, and risk appetite.

Day Trading Ethereum, Ethereum trading profits

Day trading involves buying and selling Ethereum within a single day, aiming to capitalize on short-term price fluctuations. This high-frequency approach requires constant market monitoring and a deep understanding of technical analysis. For example, a day trader might buy ETH at $1800 in the morning, anticipating a short-term price surge based on positive news or technical indicators. They’d then sell later in the day, perhaps at $1850, pocketing the $50 profit per ETH. The risk is high, as unforeseen market shifts can quickly wipe out profits, or even lead to significant losses. Profitability hinges on accurate predictions of short-term price movements, swift execution of trades, and the ability to manage risk effectively.

Swing Trading Ethereum

Swing trading holds Ethereum positions for a few days or weeks, aiming to capture larger price swings than day traders. This strategy requires less intensive monitoring than day trading but still necessitates careful analysis of price charts and market trends. Consider a scenario where a swing trader identifies a bullish pattern suggesting a price increase over the next two weeks. They might buy ETH at $1750 and hold, expecting a price increase to $1900 before selling. The risk is lower than day trading, but profits are also generally smaller, and the holding period increases exposure to longer-term market volatility. Profitability depends on correctly identifying medium-term trends and managing risk throughout the holding period.

Long-Term Holding (HODLing) Ethereum

Long-term holding, often called “HODLing” in cryptocurrency circles, involves buying and holding Ethereum for an extended period, typically months or years, regardless of short-term price fluctuations. This strategy relies on the belief that Ethereum’s underlying value will appreciate over time. For instance, an investor might buy ETH at $1500 and hold for several years, anticipating significant price appreciation driven by increased adoption or technological advancements. The risk is relatively low compared to day and swing trading, but the potential rewards are also realized over a longer time horizon. Profitability is determined by the long-term growth of Ethereum’s value and the investor’s patience.

Comparison of Ethereum Trading Strategies

The table below summarizes the key differences between these three strategies:

| Strategy | Time Commitment | Risk Tolerance | Potential Profit Margin |

|---|---|---|---|

| Day Trading | High (Several hours daily) | High | High (but potentially high losses) |

| Swing Trading | Medium (Several times a week) | Medium | Medium |

| Long-Term Holding | Low (Infrequent monitoring) | Low | Potentially High (long-term growth dependent) |

Factors Influencing Ethereum Trading Profits

Profiting from Ethereum trading isn’t just about luck; it’s a complex dance influenced by a multitude of economic, technical, and geopolitical factors. Understanding these forces is crucial for navigating the volatile world of cryptocurrency and maximizing your returns. This section will delve into the key drivers that shape Ethereum’s price and, ultimately, your trading success.

Economic Indicators and Technical Analysis

Economic indicators, often used in traditional finance, play a surprisingly significant role in Ethereum’s price. For example, macroeconomic events like inflation rates, interest rate hikes by central banks, and overall economic growth can influence investor sentiment and risk appetite, directly impacting the price of cryptocurrencies, including Ethereum. Technical analysis, on the other hand, focuses on chart patterns, trading volume, and other metrics to predict future price movements. Indicators like moving averages, relative strength index (RSI), and Bollinger Bands help traders identify potential entry and exit points, contributing to more informed trading decisions. For instance, a sustained upward trend in the 200-day moving average, coupled with a bullish RSI, might signal a favorable opportunity for long positions.

Market Sentiment, News Events, and Regulatory Changes

The cryptocurrency market is notoriously sensitive to news and sentiment. Positive news, such as major partnerships, successful network upgrades, or increased institutional adoption, can drive significant price increases. Conversely, negative news, like security breaches, regulatory crackdowns, or negative pronouncements from influential figures, can lead to sharp price drops. The speed and scale of these reactions highlight the importance of staying informed about current events. For example, the announcement of a major Ethereum improvement proposal (EIP) often triggers price movements, as investors anticipate its impact on the network’s scalability and efficiency. Similarly, regulatory uncertainty in different jurisdictions can create significant volatility. A sudden shift in regulatory stance from a major country can cause a market-wide reaction, impacting Ethereum’s price regardless of the project’s intrinsic value.

Blockchain Technology Advancements and Network Upgrades

Ethereum’s underlying technology is constantly evolving. Significant upgrades, like the transition to proof-of-stake (PoS) from proof-of-work (PoW), have a profound impact on the network’s efficiency, security, and scalability. These improvements can attract new users and investors, leading to increased demand and price appreciation. Conversely, delays or setbacks in these upgrades can negatively impact investor confidence. The successful implementation of major upgrades, such as the merge to PoS, often results in a surge in investor confidence and a positive price reaction, reflecting the market’s belief in the project’s long-term viability and technological advancements. Conversely, any unforeseen technical glitches or delays can trigger price corrections, underscoring the importance of staying abreast of the network’s development.

Risk Management in Ethereum Trading

Navigating the volatile world of Ethereum trading requires a robust risk management strategy. Without it, even the most astute trader can quickly find themselves facing significant losses. This section delves into essential risk management techniques, highlighting real-world examples and common pitfalls to avoid. Remember, preserving capital is just as crucial as generating profits.

Ethereum’s price fluctuations can be dramatic, making calculated risk management paramount. Ignoring this aspect can lead to devastating consequences, wiping out your entire investment in a short period. A well-defined risk management plan should be the cornerstone of any Ethereum trading strategy, guiding your decisions and limiting potential losses.

Stop-Loss Orders

Stop-loss orders are your safety net in the turbulent waters of Ethereum trading. They automatically sell your Ethereum when the price drops to a predetermined level, limiting potential losses. For example, if you bought ETH at $2000 and set a stop-loss order at $1800, your Ethereum will be automatically sold if the price falls to $1800, preventing further losses beyond $200, assuming you bought 1 ETH. This prevents emotional decisions during market downturns, ensuring you don’t hold onto a losing position hoping for a price rebound. The effectiveness of stop-loss orders depends on choosing appropriate levels based on your risk tolerance and market analysis.

Position Sizing

Position sizing determines how much capital you allocate to each trade. It’s crucial to avoid over-leveraging, which can magnify both profits and losses exponentially. A common rule of thumb is to risk no more than 1-2% of your total trading capital on any single trade. For instance, if you have a $10,000 trading account, you shouldn’t risk more than $100-$200 on a single Ethereum trade. This approach prevents a single losing trade from significantly impacting your overall portfolio.

Diversification

Diversification is about spreading your risk across different assets. Instead of concentrating all your capital in Ethereum, consider diversifying into other cryptocurrencies, stocks, or bonds. This reduces the impact of a downturn in the Ethereum market. For example, allocating 50% of your portfolio to Ethereum, 30% to Bitcoin, and 20% to other altcoins mitigates the risk associated with Ethereum’s price volatility. A diversified portfolio offers resilience against market fluctuations and reduces the overall risk exposure.

Examples of Poor Risk Management Leading to Losses

Imagine a trader who invested their entire life savings into Ethereum without any stop-loss orders. A sudden market crash could wipe out their investment entirely. Similarly, a trader who over-leveraged their position, borrowing heavily to buy Ethereum, could face margin calls and forced liquidation if the price falls unexpectedly. These scenarios highlight the importance of risk management in protecting your capital. The 2022 crypto winter serves as a stark reminder of the consequences of inadequate risk management, with many traders experiencing significant losses due to over-exposure and lack of diversification.

Common Pitfalls to Avoid in Ethereum Trading

Poor risk management often stems from avoidable mistakes. Here’s a list of common pitfalls to steer clear of:

- Ignoring market analysis and trading based on emotions or FOMO (fear of missing out).

- Over-leveraging and taking on excessive risk.

- Failing to use stop-loss orders or setting them too loosely.

- Lack of diversification, concentrating all your investments in a single asset.

- Ignoring risk tolerance and trading beyond your comfort zone.

- Not having a well-defined trading plan and sticking to it.

- Chasing quick profits instead of focusing on long-term growth.

- Failing to regularly review and adjust your risk management strategy.

Analyzing Ethereum Price Charts for Profitable Trades

Unlocking the secrets of Ethereum price charts is key to successful trading. By mastering technical analysis, you can move beyond gut feelings and make data-driven decisions, significantly improving your chances of profitable trades. This involves understanding candlestick patterns, moving averages, and other indicators to identify potential entry and exit points. Let’s dive into the specifics.

Technical analysis allows you to interpret historical price data to predict future price movements. It’s not about predicting the future with certainty, but about increasing the probability of successful trades by identifying trends and patterns. Combining technical analysis with fundamental analysis (understanding the underlying technology and market forces affecting Ethereum) provides a more robust trading strategy.

Candlestick Patterns and Their Significance

Candlestick patterns offer valuable insights into market sentiment and potential price reversals. These patterns, formed by the open, high, low, and close prices of a given period, provide visual representations of buying and selling pressure. Understanding these patterns allows you to anticipate shifts in market momentum.

For example, a bullish engulfing pattern, where a large green candle completely engulfs a previous red candle, often signals a potential price increase. Conversely, a bearish engulfing pattern, with a large red candle engulfing a previous green candle, suggests a potential price decline. These are not guarantees, but they significantly increase the likelihood of a price move in the indicated direction.

Moving Averages and Trend Identification

Moving averages smooth out price fluctuations, helping identify trends and potential support/resistance levels. Commonly used moving averages include the simple moving average (SMA) and the exponential moving average (EMA). The SMA gives equal weight to all data points within the period, while the EMA gives more weight to recent data.

Traders often use multiple moving averages simultaneously. For instance, a crossover of a short-term moving average (e.g., 50-day SMA) above a long-term moving average (e.g., 200-day SMA) is often considered a bullish signal, suggesting a potential uptrend. The reverse – a crossover below – is typically seen as a bearish signal.

Other Technical Indicators and Their Applications

Beyond candlestick patterns and moving averages, various technical indicators provide additional insights. The Relative Strength Index (RSI), for example, measures the magnitude of recent price changes to evaluate overbought or oversold conditions. An RSI above 70 is often considered overbought, while below 30 is considered oversold, suggesting potential price reversals.

The MACD (Moving Average Convergence Divergence) indicator identifies changes in momentum by comparing two moving averages. A bullish crossover (MACD line crossing above the signal line) can signal a potential uptrend, while a bearish crossover suggests a potential downtrend. These indicators, used in conjunction with price charts and candlestick patterns, enhance trading decision-making.

Common Chart Patterns and Their Implications

Several chart patterns consistently appear on Ethereum price charts, offering valuable clues about future price movements. Recognizing these patterns can improve your ability to identify potential trading opportunities.

- Head and Shoulders: This pattern, characterized by three peaks (the left shoulder, head, and right shoulder), often precedes a price decline. The neckline, connecting the troughs of the pattern, acts as a support level, and a break below it confirms the pattern and signals a potential sell opportunity.

- Double Top/Bottom: A double top consists of two similar price peaks, indicating potential resistance, while a double bottom shows two similar price troughs, suggesting potential support. A break above the resistance level in a double top or below the support level in a double bottom can signal a significant price movement.

- Triangles: Triangles are characterized by converging trendlines, suggesting consolidation. Symmetrical triangles often result in a breakout in either direction, while ascending triangles usually lead to price increases, and descending triangles usually lead to price decreases.

Ethereum Trading Tools and Resources

Source: medium.com

Navigating the world of Ethereum trading requires more than just market knowledge; it demands the right tools and resources. The right platform can significantly impact your trading experience, from ease of use to transaction fees. Similarly, understanding the potential of automated trading systems and knowing where to find reliable learning materials are crucial for success.

Ethereum Trading Platforms

Choosing the right Ethereum trading platform is paramount. Different platforms offer varying functionalities, fees, and user interfaces, catering to different trading styles and levels of experience. The following table compares some key features:

| Platform | Features | Fees | User Interface |

|---|---|---|---|

| Binance | Wide range of cryptocurrencies, margin trading, futures, staking, robust charting tools | Variable, dependent on trading volume and cryptocurrency | User-friendly, but can be overwhelming for beginners; offers both basic and advanced views. |

| Kraken | Advanced charting tools, margin trading, staking, strong security reputation | Competitive fees, tiered structure based on volume | Clean and intuitive, but lacks some of the bells and whistles of other platforms. |

| Coinbase Pro | User-friendly interface, good for beginners, strong regulatory compliance | Transparent fee structure, competitive for larger trades | Simple and easy to navigate, ideal for those new to crypto trading. |

| KuCoin | Large selection of cryptocurrencies, futures trading, lending services, relatively low fees | Lower fees compared to some competitors, but fees can vary | Moderately complex interface, more suitable for experienced traders. |

Utilizing Trading Bots and Automated Trading Systems

Trading bots and automated trading systems offer the potential to execute trades based on pre-defined parameters, potentially improving efficiency and minimizing emotional decision-making. However, it’s crucial to understand both their advantages and disadvantages.

Automated systems can execute trades at optimal times based on technical indicators, eliminating the need for constant monitoring. They can also process vast amounts of data much faster than a human, identifying potential trading opportunities more quickly. However, these systems are not foolproof. They are susceptible to market volatility and unexpected events, and malfunctions can lead to significant losses. Furthermore, setting up and managing these systems requires technical expertise, and understanding the underlying algorithms is crucial to avoid costly mistakes. Over-reliance on bots without proper market analysis can be detrimental.

Reliable Resources for Learning About Ethereum Trading and Market Analysis

Supplementing practical experience with theoretical knowledge is essential for successful Ethereum trading. Several resources can provide valuable insights into market analysis and trading strategies.

- Educational platforms offering courses on blockchain technology, cryptocurrency trading, and technical analysis.

- Books and articles written by experienced traders and financial analysts specializing in cryptocurrency markets.

- Communities and forums where traders share insights, strategies, and analysis.

- Financial news outlets and publications that cover cryptocurrency market trends and events.

Tax Implications of Ethereum Trading Profits

Source: stormgain.com

Navigating the world of cryptocurrency trading, especially with Ethereum, requires understanding the often-complex tax implications. Profiting from your ETH trades doesn’t just mean a fatter wallet; it also means dealing with tax authorities. This section clarifies the tax implications of Ethereum trading profits in various jurisdictions and offers strategies for minimizing your tax burden while staying on the right side of the law. Remember, this information is for general understanding and shouldn’t be considered professional tax advice. Always consult a qualified tax advisor for personalized guidance.

Tax Implications in Different Jurisdictions

Tax laws surrounding cryptocurrency vary significantly across countries. Some countries treat cryptocurrency as property, similar to stocks or real estate, while others classify it as a currency or even a commodity. This classification heavily influences how your profits are taxed. For example, in the United States, profits from selling Ethereum are generally considered capital gains, taxed at rates depending on your holding period and income bracket. Short-term gains (held for less than one year) are taxed at your ordinary income tax rate, potentially significantly higher than long-term rates. Long-term gains (held for more than one year) are taxed at preferential capital gains rates, which are generally lower. Conversely, some countries may not have specific regulations for cryptocurrency, leading to uncertainty and potential challenges in determining your tax liability. Always research the specific regulations in your country of residence.

Strategies for Minimizing Tax Liabilities

Minimizing your tax liability is a key aspect of successful cryptocurrency trading. However, it’s crucial to do so legally and ethically. One strategy is to meticulously track all your transactions. Maintain detailed records of every buy, sell, and trade, including the date, amount, and price. This documentation is vital for accurate tax reporting and can help prevent audits or penalties. Understanding the tax implications of different trading strategies is also essential. For instance, utilizing tax-loss harvesting – selling losing assets to offset gains – can help reduce your overall tax burden. Additionally, contributing to a tax-advantaged retirement account, where applicable, can further minimize your tax liability on long-term Ethereum holdings. Remember to consult with a tax professional to explore these strategies further and ensure compliance.

Tax Implications for Short-Term and Long-Term Ethereum Holdings

The tax treatment of Ethereum profits hinges significantly on whether your holdings are considered short-term or long-term. This distinction directly impacts the applicable tax rate.

| Holding Period | Tax Classification (Example: USA) | Tax Rate (Example: USA) | Example Scenario |

|---|---|---|---|

| Short-Term (Less than 1 year) | Ordinary Income | Varies based on individual income bracket (can be significantly higher) | Sold ETH after holding for 6 months, realizing a $10,000 profit. This profit is taxed at your ordinary income tax rate. |

| Long-Term (More than 1 year) | Capital Gains | Lower rates than ordinary income (varies based on income bracket) | Sold ETH after holding for 2 years, realizing a $10,000 profit. This profit is taxed at the long-term capital gains tax rate, which is typically lower than the ordinary income tax rate. |

Closing Notes

Source: newsserve.net

So, is Ethereum trading a path to riches? The answer, like the crypto market itself, is complex. While potential profits are undeniably enticing, informed decision-making is paramount. By understanding the strategies, risks, and tools at your disposal – and by employing sound risk management – you can significantly improve your chances of success in this dynamic market. Remember, consistent learning and adapting to market changes are key to navigating the ever-evolving landscape of Ethereum trading and ultimately, securing those sweet, sweet profits.