Evolution Bitcoin trading platforms: From clunky early exchanges to the sleek, sophisticated platforms of today, the journey of Bitcoin trading has been nothing short of a technological rollercoaster. This isn’t just about buying and selling; it’s about the seismic shifts in security, regulation, and user experience that have shaped how we interact with this revolutionary currency. Get ready to explore the wild ride.

This deep dive examines the historical context, dissects the various types of platforms available, explores the crucial security measures involved, navigates the complex regulatory landscape, and finally, peers into the crystal ball to predict the future of Bitcoin trading. We’ll unpack the technological advancements, analyze the impact on Bitcoin adoption, and leave no stone unturned in understanding this dynamic ecosystem.

Historical Overview of Bitcoin Trading Platforms

The world of Bitcoin trading platforms has undergone a dramatic transformation since the cryptocurrency’s inception. From rudimentary, often insecure exchanges, we’ve progressed to sophisticated platforms boasting advanced features and robust security protocols. This evolution reflects not only the growing maturity of the cryptocurrency market but also the rapid advancements in blockchain technology and financial infrastructure.

Early platforms were largely characterized by their simplicity and, unfortunately, their vulnerability. Limited functionality, poor user interfaces, and lax security measures were common. However, as Bitcoin’s popularity exploded, so too did the demand for more robust and user-friendly trading platforms. This spurred innovation and competition, driving the development of the sophisticated platforms we see today.

Technological Advancements Driving Platform Evolution

The evolution of Bitcoin trading platforms is intrinsically linked to significant technological advancements. Improved order book management systems, for example, have enabled faster and more efficient trading, allowing for the processing of a far greater volume of transactions. Simultaneously, the development of more sophisticated security measures, including multi-factor authentication, cold storage solutions, and advanced fraud detection systems, has drastically enhanced the security of these platforms, mitigating risks associated with hacking and theft. The integration of advanced charting tools and analytical dashboards has also empowered traders with better data visualization and informed decision-making capabilities.

Timeline of Key Milestones

The following table provides a simplified timeline of key milestones in the development of Bitcoin trading platforms. It’s important to note that this is not an exhaustive list, and many other significant platforms have contributed to the overall evolution of the industry.

| Year Launched | Platform Name (Example) | Key Features | Security Measures | Approximate Trading Volume (USD) |

|---|---|---|---|---|

| 2010-2011 | Early Bitcoin Forums/Direct Trades | Basic peer-to-peer trading, limited functionality | Minimal security, reliance on trust | Very Low |

| 2011-2013 | Mt. Gox (early stages) | Increased user base, centralized exchange | Basic security measures, vulnerable to hacking | Growing, but still relatively low |

| 2013-2015 | Bitstamp, Kraken (early stages) | Improved user interfaces, more sophisticated order books | Enhanced security protocols, improved KYC/AML procedures | Significantly increased |

| 2015-Present | Binance, Coinbase, Kraken (mature stages) | Advanced charting tools, margin trading, derivatives, mobile apps, robust APIs | Multi-factor authentication, cold storage, advanced fraud detection, insurance funds | Extremely high, billions of USD daily |

Types of Bitcoin Trading Platforms

Source: businessmensedition.com

Navigating the world of Bitcoin trading can feel like stepping into a futuristic marketplace, brimming with choices and complexities. Understanding the different types of platforms is crucial for choosing the right one to match your trading style and risk tolerance. Essentially, Bitcoin trading platforms fall into three main categories: centralized exchanges, decentralized exchanges, and peer-to-peer platforms. Each offers a unique set of features, benefits, and drawbacks.

Centralized Exchanges (CEXs)

Centralized exchanges act as intermediaries, holding your Bitcoin and facilitating trades between buyers and sellers. Think of them as the traditional stock exchanges of the crypto world, but with added layers of complexity due to the decentralized nature of Bitcoin itself. They generally offer a wide range of cryptocurrencies, user-friendly interfaces, and high liquidity, meaning you can buy and sell quickly without significantly impacting the price. However, this convenience comes with inherent risks.

Advantages and Disadvantages of Centralized Exchanges

- Advantages: High liquidity, user-friendly interfaces, wide selection of cryptocurrencies, often offer additional services like staking and lending.

- Disadvantages: Security risks associated with holding large sums of user funds, susceptibility to hacks and theft, potential for regulatory scrutiny and restrictions, KYC/AML compliance requirements.

User Experience and Interface Design of Centralized Exchanges

CEXs typically boast polished, intuitive interfaces designed for ease of use, even for beginners. Many incorporate order books, charting tools, and other features borrowed from traditional finance. However, the level of sophistication varies widely. Some platforms cater to casual traders with simplified interfaces, while others offer advanced charting and order types for experienced traders. The overall design often prioritizes a clean and visually appealing experience, aiming for user-friendliness above all else.

Examples of Centralized Exchanges

- Coinbase: Known for its user-friendly interface and robust security measures, Coinbase is a popular choice for beginners. It’s regulated in many jurisdictions, offering a degree of security and trust.

- Binance: One of the largest exchanges globally, Binance offers a wide range of cryptocurrencies and advanced trading features, appealing to both beginners and experienced traders. However, its regulatory history is more complex.

- Kraken: Kraken is another large exchange that is known for its advanced charting tools and relatively low fees, making it a favored choice among more experienced traders.

Decentralized Exchanges (DEXs)

Decentralized exchanges operate without a central authority, using smart contracts and blockchain technology to facilitate trades directly between users. This eliminates the need to trust a third-party custodian with your funds, offering a higher degree of security and privacy. However, DEXs often come with a steeper learning curve and may have lower liquidity than CEXs.

Advantages and Disadvantages of Decentralized Exchanges

- Advantages: Increased security and privacy due to the absence of a central authority, non-custodial nature protects users from exchange hacks, censorship-resistant.

- Disadvantages: Often more complex to use, potentially lower liquidity compared to CEXs, higher transaction fees in some cases, user interface can be less intuitive for beginners.

User Experience and Interface Design of Decentralized Exchanges

DEX interfaces can vary wildly in terms of user-friendliness. Some DEXs have made significant strides in improving usability, offering interfaces that are comparable to CEXs. Others, however, maintain a more technical and complex design, catering primarily to experienced users comfortable with blockchain technology and decentralized applications (dApps).

Examples of Decentralized Exchanges

- Uniswap: A pioneer in the DEX space, Uniswap is known for its automated market maker (AMM) model and its simplicity. It’s a popular choice for trading ERC-20 tokens on the Ethereum blockchain.

- PancakeSwap: A leading DEX on the Binance Smart Chain, PancakeSwap offers a similar AMM model to Uniswap but with potentially lower transaction fees.

- SushiSwap: SushiSwap is another popular DEX built on the Ethereum blockchain, known for its governance token and yield farming opportunities.

Peer-to-Peer (P2P) Platforms

P2P platforms connect buyers and sellers directly, without an intermediary. This offers a high degree of privacy and control, but also comes with increased risk, as you’re relying on the trustworthiness of the other party. Liquidity can be lower than on exchanges, and finding a suitable counterparty might take time.

Advantages and Disadvantages of Peer-to-Peer Platforms

- Advantages: Increased privacy, direct control over transactions, potentially better prices due to the absence of exchange fees.

- Disadvantages: Higher risk of scams and fraud, lower liquidity, finding a suitable counterparty can be challenging, potentially slower transaction times.

User Experience and Interface Design of Peer-to-Peer Platforms

P2P platforms generally have simpler interfaces than exchanges, often focusing on facilitating communication and secure transactions between users. The user experience can vary greatly depending on the platform’s design and features. Some platforms offer escrow services to mitigate risks, while others rely solely on user trust and reputation systems.

Examples of Peer-to-Peer Platforms

- LocalBitcoins: A well-known P2P platform that allows users to buy and sell Bitcoin directly with other users in their local area. It features a reputation system to help users assess the trustworthiness of their counterparties.

- Paxful: Paxful is another popular P2P platform that supports a wide range of payment methods, making it accessible to a broader range of users.

Security Features and Practices: Evolution Bitcoin Trading Platforms

The wild west days of Bitcoin trading are thankfully behind us. Early platforms often lacked robust security, leading to significant losses for users. Today, while not foolproof, reputable exchanges employ sophisticated security measures to protect both themselves and their customers’ assets. Understanding these measures, and how to leverage them, is crucial for anyone navigating the world of cryptocurrency trading.

The evolution of security on Bitcoin trading platforms has been a direct response to past exploits. Early platforms relied heavily on basic password protection, leaving them vulnerable to various attacks. The rise of sophisticated hacking techniques, coupled with the high value of Bitcoin, forced platforms to adapt and implement more robust security protocols. This evolution includes a shift towards multi-factor authentication, improved encryption methods, and the widespread adoption of cold storage for the majority of user funds.

Evolution of Security Protocols

The security landscape has dramatically shifted. Initially, simple passwords were the primary line of defense. This quickly proved inadequate. The introduction of two-factor authentication (2FA), requiring a second verification method like a code from a mobile app or email, significantly raised the bar. Cold storage, where the majority of Bitcoin is stored offline in secure, physically protected locations, became a standard practice to mitigate the risk of hacking digital wallets. Advanced encryption techniques, such as AES-256, are now commonly used to protect sensitive user data. Furthermore, regular security audits and penetration testing are becoming increasingly common among reputable exchanges to proactively identify and address vulnerabilities.

Common Vulnerabilities and Exploits

Historically, several vulnerabilities have plagued Bitcoin trading platforms. SQL injection attacks, allowing hackers to manipulate database queries, have been used to steal user data, including login credentials. Phishing scams, designed to trick users into revealing their login information, remain a persistent threat. Cross-site scripting (XSS) attacks, injecting malicious scripts into websites, can compromise user sessions. Furthermore, vulnerabilities in platform code, often discovered through penetration testing, have allowed hackers to exploit weaknesses and gain unauthorized access to user funds. The infamous Mt. Gox hack, which resulted in the loss of millions of dollars worth of Bitcoin, serves as a stark reminder of the potential consequences of inadequate security.

Best Practices for Securing Accounts

Protecting your Bitcoin on a trading platform requires a multi-layered approach. Always enable 2FA on your account. Choose a strong, unique password that is not reused on other websites. Be wary of phishing emails and websites that mimic legitimate platforms. Regularly review your account activity for any unauthorized transactions. Only use reputable and well-established trading platforms with a proven track record of security. Consider using a hardware security key for an additional layer of 2FA protection. Finally, understand that no system is perfectly secure; diversification across multiple platforms, with only a small amount of Bitcoin on any one exchange, can help mitigate risk.

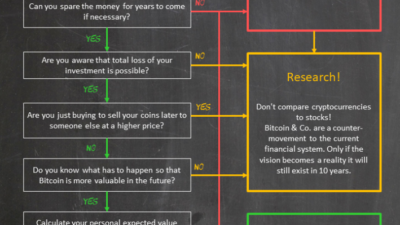

Securing a Bitcoin Trading Account: A Flowchart

Imagine a flowchart with these steps:

1. Choose a Reputable Exchange: Select a platform with a strong security reputation and positive user reviews.

2. Enable Two-Factor Authentication (2FA): Activate 2FA using a mobile authenticator app or email verification.

3. Create a Strong Password: Use a unique, complex password that includes uppercase and lowercase letters, numbers, and symbols.

4. Regularly Update Password: Change your password periodically to minimize the risk of unauthorized access.

5. Enable Email Notifications: Receive alerts for login attempts and other account activity.

6. Beware of Phishing Attempts: Be cautious of suspicious emails or websites requesting your login information.

7. Use a Hardware Security Key (Optional): Enhance 2FA security with a physical security key.

8. Regularly Review Account Activity: Check your transaction history for any unauthorized activity.

9. Diversify Your Holdings: Spread your Bitcoin across multiple exchanges to minimize risk.

10. Keep Software Updated: Ensure your operating system and browser are up-to-date with security patches.

Regulatory Landscape and Compliance

Source: co.ke

The wild west days of cryptocurrency are fading, replaced by a slowly solidifying regulatory landscape. Bitcoin trading platforms, once operating in a largely unregulated space, now face increasing scrutiny from governments worldwide. This shift has dramatically altered how these platforms function, impacting everything from security protocols to the services they offer. Understanding this evolving regulatory environment is crucial for both platform operators and users.

The global regulatory approach to Bitcoin trading platforms is a patchwork quilt of different rules and interpretations. Some jurisdictions have embraced a relatively hands-off approach, while others have implemented stringent regulations aimed at protecting consumers and preventing illicit activities. This uneven landscape creates challenges for platforms seeking to operate internationally, forcing them to navigate a complex web of legal requirements. The impact of these regulations is far-reaching, influencing everything from KYC/AML compliance to the types of trading offered.

Global Regulatory Evolution

Regulations concerning Bitcoin trading platforms have evolved significantly over the past decade. Initially, most jurisdictions lacked specific legislation addressing cryptocurrencies. However, as Bitcoin’s popularity grew and concerns about money laundering, terrorist financing, and market manipulation emerged, governments began to take notice. Early responses were often fragmented and inconsistent, with some countries banning crypto altogether, while others adopted a more permissive approach. More recently, there’s been a global trend towards establishing clearer regulatory frameworks, often involving licensing requirements, anti-money laundering (AML) and know-your-customer (KYC) rules, and consumer protection measures. This evolution reflects a growing understanding of the potential benefits and risks associated with cryptocurrencies.

Comparative Jurisdictional Approaches

Different jurisdictions have adopted distinct approaches to regulating Bitcoin trading platforms. For example, the United States has a decentralized regulatory system, with different agencies overseeing various aspects of the cryptocurrency market. The Securities and Exchange Commission (SEC) focuses on securities-related issues, while the Financial Crimes Enforcement Network (FinCEN) addresses AML concerns. In contrast, countries like Japan and Singapore have implemented more centralized regulatory frameworks, with specific agencies responsible for overseeing cryptocurrency exchanges. The European Union is working towards a more harmonized approach through the Markets in Crypto-Assets (MiCA) regulation, aiming to create a consistent set of rules across member states. These varying approaches highlight the challenges of creating a globally consistent regulatory environment for cryptocurrencies.

Impact of Regulatory Changes, Evolution bitcoin trading platforms

Regulatory changes have profoundly impacted the functionality and operation of Bitcoin trading platforms. KYC/AML requirements, for instance, have forced platforms to implement robust identity verification processes, increasing operational costs and potentially impacting user experience. Licensing requirements have raised the bar for entry into the market, potentially reducing the number of smaller platforms. Furthermore, regulations related to market manipulation and consumer protection have led to increased transparency and accountability among platforms. The overall impact has been a move towards a more regulated and mature market, albeit one that remains complex and evolving.

Regulatory Landscape Overview

| Region | Regulatory Body | Key Regulations |

|---|---|---|

| United States | SEC, FinCEN, CFTC | Various regulations concerning securities, AML, and derivatives |

| European Union | European Commission | MiCA (Markets in Crypto-Assets) regulation |

| Japan | Financial Services Agency (FSA) | Regulations on cryptocurrency exchange licensing and operation |

| Singapore | Monetary Authority of Singapore (MAS) | Regulations focusing on licensing, AML, and consumer protection |

| United Kingdom | Financial Conduct Authority (FCA) | Regulations governing cryptoasset activities, including AML and consumer protection |

The Future of Bitcoin Trading Platforms

The wild west days of Bitcoin trading are fading. While volatility remains a key characteristic, the platforms themselves are undergoing a significant evolution, driven by technological advancements and a growing need for robust security and regulatory compliance. The future of these platforms promises a more sophisticated, secure, and user-friendly experience, catering to both seasoned crypto traders and newcomers alike.

Emerging Trends in Bitcoin Trading Platform Technology

Decentralized finance (DeFi) and artificial intelligence (AI) are two powerful forces reshaping the Bitcoin trading landscape. DeFi protocols are enabling the creation of decentralized exchanges (DEXs) that offer greater transparency and security compared to centralized exchanges (CEXs). These DEXs often utilize smart contracts to automate trading processes, reducing reliance on intermediaries and potentially lowering fees. Meanwhile, AI is being integrated into trading platforms to enhance various aspects of the user experience, from providing personalized trading recommendations based on sophisticated algorithms to improving fraud detection and risk management. For instance, AI-powered sentiment analysis tools can help traders gauge market sentiment and make more informed decisions, while AI-driven algorithms can detect and prevent wash trading and other manipulative activities. The combination of DeFi and AI promises a future where Bitcoin trading is more efficient, secure, and accessible.

Future Developments in Security and Regulation of Bitcoin Trading Platforms

The security of Bitcoin trading platforms is paramount. Future developments will likely focus on advanced encryption techniques, multi-factor authentication (MFA), and robust cold storage solutions to protect user funds. Blockchain technology itself, underpinning Bitcoin, will play a crucial role in enhancing security by providing an immutable record of transactions. Regulatory scrutiny will also intensify, leading to stricter KYC/AML (Know Your Customer/Anti-Money Laundering) procedures and increased transparency requirements for platforms. We can expect to see more regulatory frameworks emerge globally, mirroring the regulatory evolution of traditional financial markets, aiming to balance innovation with consumer protection. This could include stricter licensing requirements and greater oversight of platform operations.

Impact of Technological Advancements on User Experience

Technological advancements are poised to significantly improve the user experience on Bitcoin trading platforms. Intuitive interfaces, personalized dashboards, and mobile-first designs will become the norm, making trading more accessible to a wider audience. AI-powered tools will provide users with real-time market analysis, personalized trading recommendations, and automated trading strategies. The integration of educational resources and tutorials will empower users to make more informed decisions. Moreover, the rise of decentralized exchanges and improved accessibility through mobile apps will significantly lower the barrier to entry for new users. Imagine a future where trading Bitcoin is as easy as using a popular banking app.

Potential Future Innovations in Bitcoin Trading Platform Design and Functionality

The future holds exciting possibilities for Bitcoin trading platforms. Consider these potential innovations:

- Seamless cross-chain trading: Enabling users to trade Bitcoin across different blockchains with ease.

- Decentralized identity solutions: Reducing reliance on centralized KYC/AML processes.

- Advanced charting and analytics tools: Providing users with even more sophisticated market insights.

- Integrated tax reporting features: Simplifying the complexities of crypto tax compliance.

- Social trading features: Allowing users to follow and copy the trades of experienced traders.

- Enhanced security features: Implementing biometric authentication and advanced fraud detection systems.

Impact on Bitcoin Adoption

Source: crypto.com

Bitcoin trading platforms haven’t just been passive observers in Bitcoin’s meteoric rise; they’ve been active catalysts, shaping its accessibility and driving its adoption among a global audience. Their evolution, from clunky early interfaces to sophisticated, user-friendly platforms, mirrors Bitcoin’s own journey from niche curiosity to a significant asset class. The ease of buying, selling, and managing Bitcoin directly correlates with the expansion of its user base and, consequently, its market capitalization.

The evolution of Bitcoin trading platforms has significantly impacted Bitcoin’s accessibility and usability. Initially, navigating the world of Bitcoin required a high degree of technical expertise. Early platforms were often complex, requiring users to understand cryptographic principles and command-line interfaces. This limited adoption to a small group of tech-savvy individuals. However, as platforms matured, user interfaces became increasingly intuitive, resembling familiar stock trading platforms. The introduction of features like mobile apps, simplified order placement, and educational resources further democratized access, allowing individuals with limited technical knowledge to participate in the Bitcoin market. This simplification was crucial in broadening Bitcoin’s appeal beyond its initial niche audience.

Platform Advancements and Increased Accessibility

The shift from complex, text-based interfaces to user-friendly graphical user interfaces (GUIs) was a major turning point. Imagine the early days: users needing to manually input complex commands and decipher cryptic error messages. Now, many platforms boast sleek designs and intuitive navigation, comparable to popular online banking or e-commerce sites. Features like integrated wallets, secure storage options, and real-time price tracking have further enhanced the user experience, removing many of the initial barriers to entry. The integration of fiat on-ramps, allowing direct purchases using traditional currencies like USD or EUR, was another critical step in making Bitcoin accessible to a broader audience. This eliminated the need for users to navigate complex peer-to-peer exchanges or understand the intricacies of cryptocurrency wallets.

Correlation Between Platform Improvements and Market Capitalization

A clear correlation exists between improvements in Bitcoin trading platforms and the growth of Bitcoin’s market capitalization. As platforms became more user-friendly and accessible, the number of Bitcoin users surged. This increased demand, coupled with limited supply, directly contributed to the rise in Bitcoin’s price and overall market capitalization. We can observe a clear upward trend: the simpler and more secure the platforms became, the faster Bitcoin’s market cap expanded. This isn’t simply correlation; the improved platforms acted as a crucial infrastructure enabling wider participation and fueling market growth.

Visual Representation of Platform Advancements and Bitcoin Adoption

Imagine a graph with two lines. The X-axis represents time, spanning from Bitcoin’s inception to the present. The Y-axis on the left represents Bitcoin’s market capitalization, displayed as a steadily rising curve, initially slow, then accelerating sharply. The Y-axis on the right shows a parallel line representing the complexity of Bitcoin trading platforms, starting high (representing complex interfaces) and gradually declining over time as platforms become more user-friendly. The two lines show a strong positive correlation: as the platform complexity line descends, the Bitcoin market capitalization line ascends, demonstrating a clear relationship between platform improvements and increased adoption. The steepest incline in both lines corresponds to periods marked by significant platform innovations like the introduction of mobile apps, fiat on-ramps, and improved security features.

Epilogue

The evolution of Bitcoin trading platforms isn’t just a story of technological progress; it’s a reflection of Bitcoin’s own maturation as a global asset. From rudimentary beginnings to the sophisticated, heavily regulated exchanges of today, the journey underscores the increasing mainstream acceptance of cryptocurrencies. As technology continues to evolve, expect even more innovative platforms to emerge, making Bitcoin more accessible and user-friendly than ever before. The future is bright, and it’s decentralized.